Influencer Marketing in India

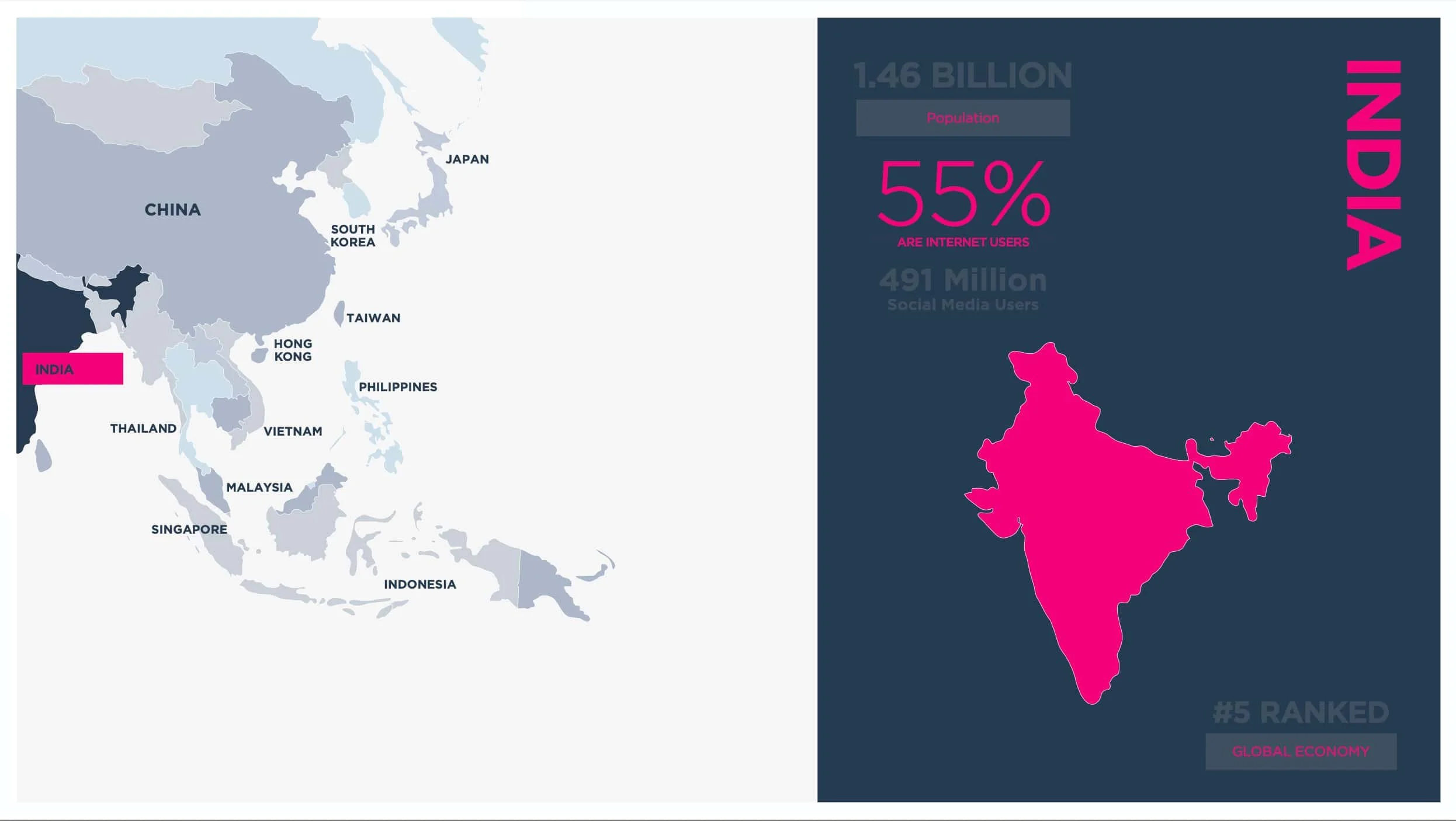

India is one of the world’s most dynamic digital markets, with 692 million internet users and 491 million social media users—yet penetration remains under 50%, pointing to huge untapped potential.

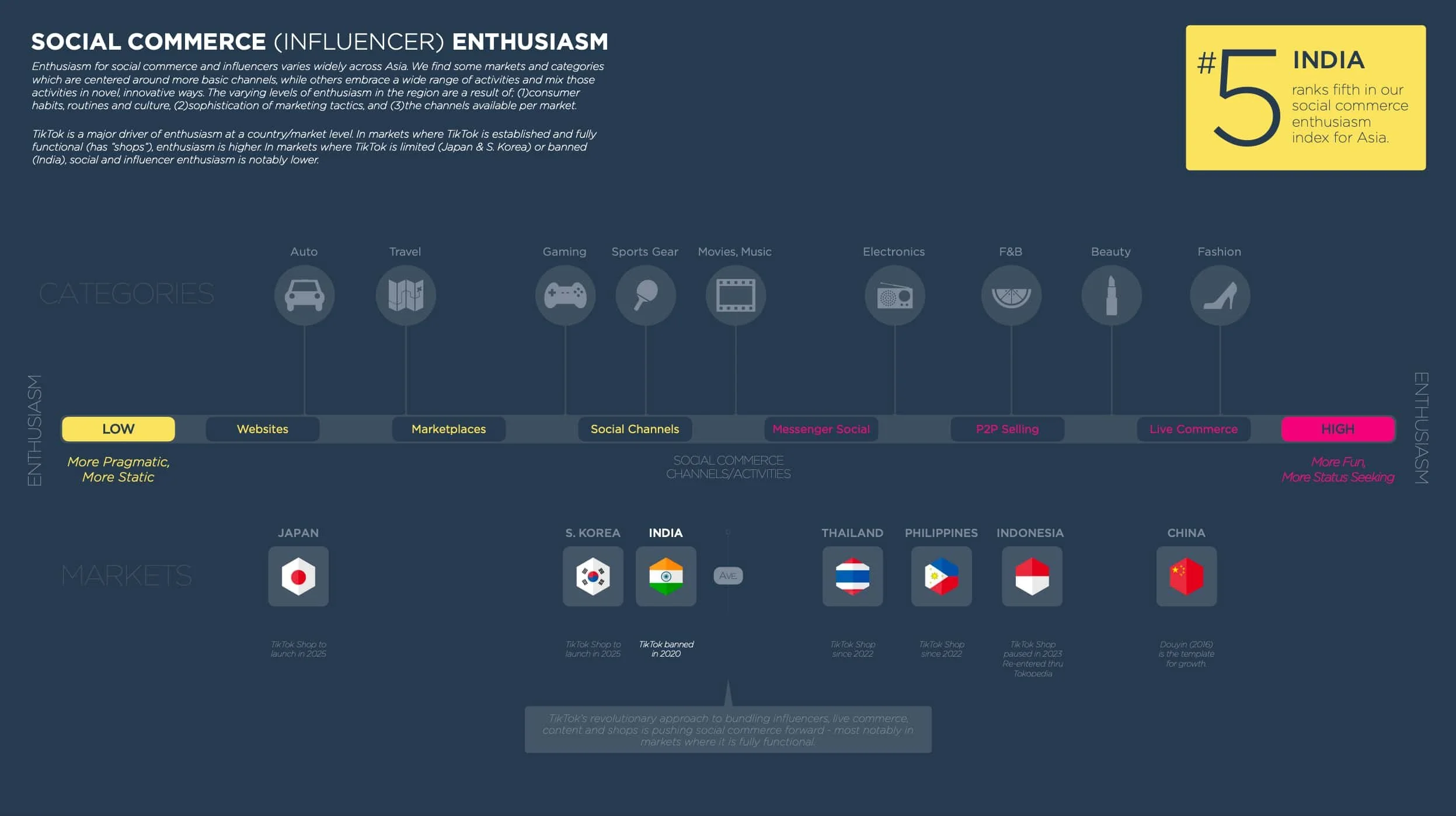

This mini-report, part of Totem’s regional analysis of influencers in Asia, shows how India’s market is defined by mobile-first adoption, price sensitivity, and regional diversity. Despite TikTok’s ban in 2020 (removing more than 200M users overnight), India still ranks #5 on our Social Commerce Enthusiasm Index — a sign of resilience and opportunity.

𝗞𝗲𝘆 𝗜𝗻𝘀𝗶𝗴𝗵𝘁𝘀:

Micro & Nano influencers outperform in effectiveness—trusted more than celebrities or mega-influencers across the purchase journey.

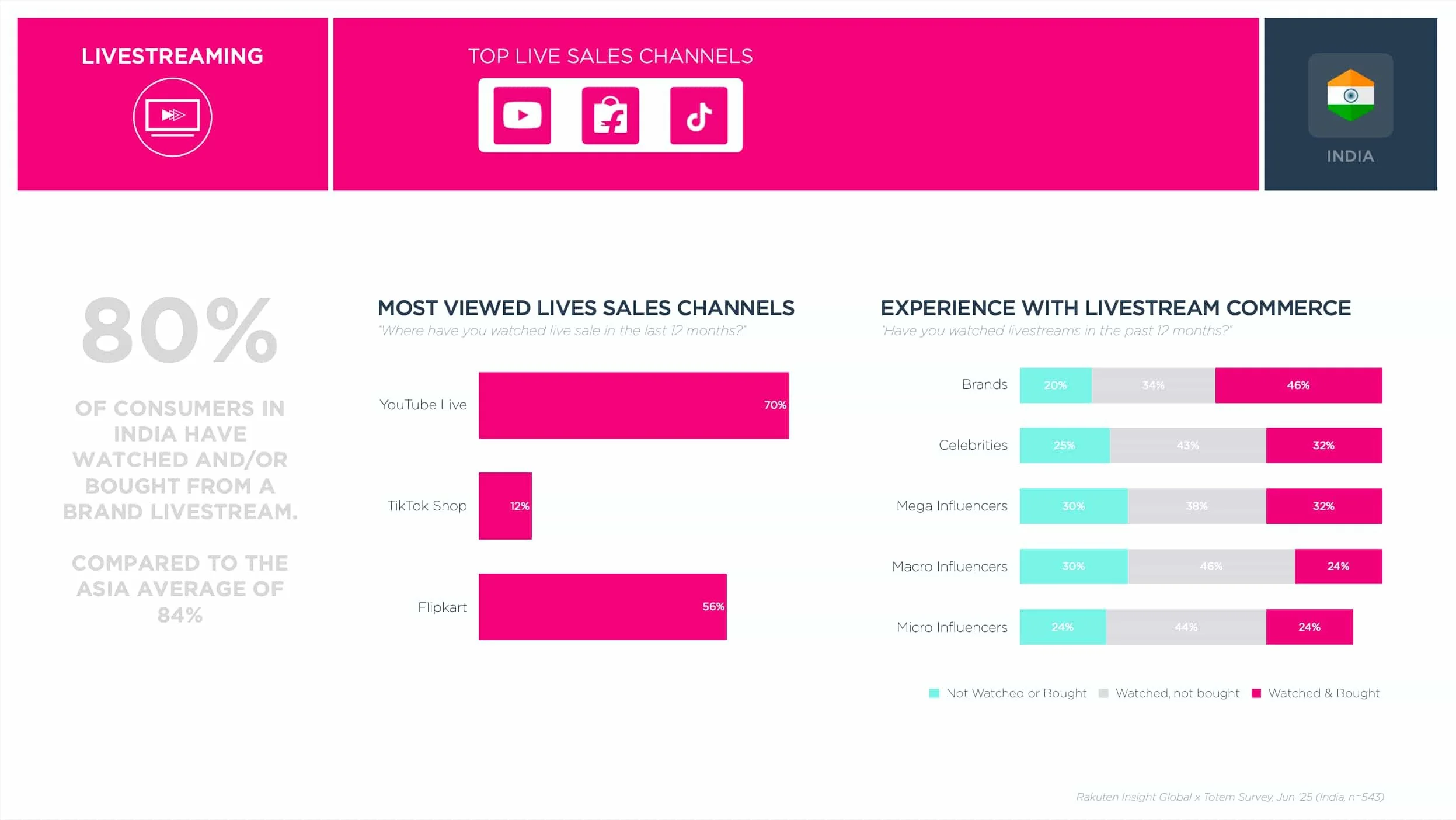

Livestream commerce in post-TikTok world: 80% of consumers have watched or bought from livestream sales (vs. 84% Asia average).

YouTube & Instagram dominate influencer content consumption, while WhatsApp adds a unique utility layer for commerce and community

Consumers crave demos and deals—but concerns around privacy and product quality remain barriers to conversion

With India’s booming creator economy and rapid e-commerce growth, the stage is set for influencer-led commerce to accelerate—especially as brands learn to localize strategies for India’s fragmented, mobile-first audience.

*Thanks to Rakuten Insight Global for their amazing work in conducting the consumer research across seven markets. Also a big thanks to Campaign Asia for their detailed reporting on the findings of this report.